Source Forbes.com NEW DELHI, Sept 23 (Reuters) - Indian art might be just the solution for investors seeking a safe haven at a turbulent time.

Take a vivid landscape by avant-garde artist Francis Newton Souza hanging on a wall in Indian art dealer Ashish Abnand's New Delhi gallery. With a price tag of $400,000, the painting might not seem like a bargain but Abnand says it will probably be worth $2 million within the next two years.

Art dealers and experts say the Indian art market is still undervalued and there is money to be made in local art for those with the means to pay the six figure prices that works by some of India's leading artists fetch at auctions.

"I think Indian art is a one-way bet in the long term. That's why I will allocate money to it," said Philip Hoffman who runs the Fine Art Fund based in London.

"If you look 50 years down the line, what you pay now is peanuts compared to what you will have to pay for the great Indian artists," he told Reuters at an Indian art summit in New Delhi in August.

The prices of Indian art have gone up considerably but not at the levels of Chinese art, which has seen prices soar due to enormous interest at home and abroad. Dealers believe Indian works have plenty of room to appreciate, especially as South Asian art begins to draw a Western audience.

"The growth potential is huge," said Hugo Weihe, Christie's international director of Asian Art.

"The Indian art market is particularly strong within India and that's different from the Chinese contemporary. You have that component plus we are now reaching out to an international component every season."

Often depicting vivid and colourful scenes of Indian life and culture, Indian art has long been popular among wealthy Indians, whose ranks are growing rapidly in a booming economy. Yet until recently Western collectors had not taken much interest in classical and contemporary Indian artists.

That is starting to change. Weihe predicts that sales of Indian art at Christie's auctions might reach $30 million this year, compared with $680,000 in 2000.

SKYROCKETING VALUATIONS

Asia's art scene has blossomed in the past five years driven by the continent's rapid economic growth. Valuations have skyrocketed as Asian art has become an investment for speculators and a symbol of affluence for a growing pool of local collectors.

The record for a contemporary Indian art work was set in June when Francis Newton Souza's piece 'Birth' was sold for $1.3 million pounds ($2.3 million).

The figure was, nevertheless, significantly lower than the $9.7 million record price for Chinese artist Zeng Fanzhi's piece 'Mask Series 1996 No. 6' sold at an auction in Hong Kong in May.

Works by famous Indian artists such as Maqbool Fida Husain and Syed Haider Raza currently go under the hammer for anywhere from $200,000 to $1 million.

Yet industry players expect prices to shoot up to between $5 million to $10 million in the next few years.

Neville Tuli, a manager of a $400 million art fund in India, believes that Indian art will appreciate by between 18 to 25 percent per year in a climate in which art is increasingly seen as a secure investment.

"Financial institutions and their HNIs (high net worth individuals) are recognising the inherent stability in the art object as a capital asset," said Neville Tuli, a manager of a $400 million art fund in India.

"Hence given its low correlation to economic circumstances and other related factors, the proportion of art within the alternative asset allocation is increasing significantly," he added.

HOT MONEY CANVASES ART

But as with all investments, there are risks. The Indian market is vastly different from the Western art markets because in India, art is viewed more as a financial investment rather than a collectors item, art fund managers said.

"It has gone up 200 times in five years," said Hoffman, of the London-based Fine Art Fund, adding that the Indian market consisted of 70 percent speculators and 30 percent collectors.

This trend of rapid buying and selling, makes it difficult to predict long term value. "Let's say you've got a Gupta," Hoffman said, referring to Subodh Gupta, one of India's hot new artists whose pieces sell for between $800,000 to $1 million. "It's a financial commodity like a stock," Hoffman said.

"You need the Bill Gates of this world to say I want a Gupta and I don't give a damn how much it cost. It's going into my collection and it's not for sale," he added, saying a growing pool of collectors will give the market stability. Art experts would like to see more people like Kusam Sani, a wealthy fashion consultant based in Delhi, who is one of the few art collectors who keeps the art they buy.

"I have a 40 foot dining room and it's covered with work, but I can't buy anymore because I've got no more space," said Sani, who has been collecting paintings since she was a teenager.

Greater government investment in art infrastructure and museums will give the market stability in the long term, experts said, although they noted that so far the Indian government has shown little political will to support such projects.

There are also bureaucratic hurdles such as permits to export works of art and requirements to register antiques with government bodies that turn acquisitions of Indian art into a headache for dealers and collectors abroad.

But despite the market's shortcomings, art dealers, Weihe and Hoffman are bullish on Indian art.

"The Indian market will mature when the real collector base is grown up and put the money is put to one side," Hoffman said.

"In the long run, all these artists are going to be global, they just happen to be local at the moment."

mardi 23 septembre 2008

FEATURE-Indian art offers high appreciation in volatile climate

lundi 22 septembre 2008

Art Market Watch

Source artnet.com Sept. 22, 2008

The contemporary art market is not, as one might have thought last week, all about Damien Hirst. Several other contemporary auctions took place in New York in September 2008. A brief report follows.

Christie’s "First Open" sale in its Rockefeller Center salesroom featured 229 lots, of which 169 found buyers, or 74 percent, for a total of $6,507,800, just at the presale low estimate $6 million. The top lot, Cindy Sherman’s Untitled Film Still #13 (1978), a black-and-white photo of a buxom blonde reaching for a library book, sold for $902,500, almost double its presale high estimate of $500,000. Among the top ten, works by Jeff Koons and Robert Cottingham surpassed their high estimates.

Several other works soared above their presale estimates, including a largish (19 x 21 in.) drawing of Jackie Robinson from 1991 by Raymond Pettibon that sold for $37,500 (est. $12,000-$18,000). How did our picks do [see Art Market Watch, Sept. 9, 2008]? Well, Richard Prince’s cast flip flops, modestly estimated at $25,000 or more, failed to sell, as did Andy Warhol’s model for his BMW Art Car, at $250,000-$350,000.

But Tony Feher’s sculpture of four jars with red tops sold for $18,750, rather more than the presale high estimate of $6,000, and Sharon Core’s 2003 color photograph of a coconut cake surrounded by eight cake slices -- an homage to a similar painting by Wayne Thiebaud -- went for $15,000, almost three times the presale high estimate of $6,000. The sale represented a debut at auction for Core, and is of course a new auction record for her work.

Sotheby’s New York’s "midseason" sale of contemporary art on Sept. 10, 2008, which carried a overall presale estimate of $9.8 million-$14 million, totaled $10,556,939, with 285 of 412 lots finding buyers, or just over 69 percent. Works by Roy Lichtenstein, Robert Indiana, Adolph Gottlieb and Josef Albers were top sellers. Paintings by members of the Bay Area Figurative movement also did well, with Elmer Bischoff’s Rooftops and Bay (1961) going for $134,500, above its presale high estimate of $120,000, and David Park’s small watercolor Four Nudes from 1960 going for $104,000, more than triple the presale low estimate of $30,000.

Good prices were also paid for works by Chantal Joffe, whose ten-foot-tall Long Haired Brunette with White Wallpaper sold for $68,500, more than double the presale high estimate of $30,000, and a 1994 mixed media painting by Ouattara Watts, Gindo Voodoo, sold for $34,375, over a presale estimate of $6,000-$8,000. Both prices are new auction records for the artists.

What’s more, Christie’s held its first contemporary design sale on Sept. 8, 2008, a relatively low-key event that totaled $1,161,500, with 21 of 30 lots finding buyers, or 70 percent. The overall presale estimate was $1.2 million-$1.7 million. Christie’s specialist Carina Villinger called the results "promising" and noted "enthusiastic global interest indicating a sold and evolving contemporary design market."

Most of the top prices came in at the lower end of their presale estimates, though the sums were substantial all the same. A Ron Arad mirror-polished, stainless steel D sofa designed in 1995 went for $206,500 (est. $200,000-$300,000), while a Shiro Kuramata acrylic and aluminum stool with feathers designed in 1990 sold for $86,500 (est. $80,000-$100,000).

Then there were the Asian Art Week sales, during the third week in September, a bit overshadowed by Hirst-mania, not to mention the Wall Street turmoil. With both Chinese and Indian contemporary art, top-level buyers are increasingly native, rather than from the U.S. or Europe. This market dynamic is reflected by the decision of both houses to move their Asian contemporary sales to Hong Kong, where they are initiating evening sales of Asian art in October. Christie’s skipped holding a sale of contemporary Asian art in New York this week, and the sale at Sotheby’s on Sept. 17, 2008, was the last such dedicated sale in the city, at least for the time being.

Still, Christie’s New York held eight separate sales for Asia week, Sept. 15-18, 2008, totaling $51.1 million overall, which the firm called its second-highest total for the category of sales in New York. Christie’s South Asian modern and contemporary art sale on Sept. 16, 2008, totaled $12,634,375, with 84 of 126 lots selling, or 67 percent.

The artist Subodh Gupta (b. 1964), who makes both paintings and sculpture, is the shining light of the Indian contemporary market, with a Pop consumerist esthetic that has been compared to that of Jeff Koons, as well as a recent auction record, set in June 2008, of $1.18 million. At Christie’s, his works took three of the four top spots. Steal 2 (2007), a 66 x 90 in. oil on canvas reproducing a detail of one of his famous accumulation sculptures of stainless steel cooking utensils, sold for $1,166,500, just above the presale high estimate of $1,000,000

Gupta’s Miter (2007), an actual collection of such utensils -- installed in a corner in the shape of a Valentine’s Day heart -- sold for $1,022,500; it is one of an edition of three. The third Gupta work was an untitled 2005 painting from his migration series, showing luggage on a wheeled cart at an airport. It sold for $962,500 (est. $600,000-$800,000).

As for Sotheby’s, its New York series of four Asian art sales, Sept. 16-19, 2008, totaled $26,008,097 overall, falling just short of the presale low estimate of $27.9 million. The sale of Asian contemporary art from China, Korea and Japan on Sept. 17, 2008, totaled $8,513,288, with 137 of 211 lots selling, or almost 65 percent.

Of the top nine lots, seven were snapped up by Asian buyers, according to Sotheby’s. The top lot was a relatively small (39 x 32 in.) 1997 work from Zeng Fanzhi’s Mask Series, an auction-room favorite, here showing a suavely suited Chinese businessman with a Boston terrier on a beach, that went for $1,082,500 (est. $900,000-$1,200,000). The artist, whose auction record is $9.7 million, is having a show at Acquavella Galleries in New York this fall.

Soaring past their presale estimates were a 1957 Braque-inspired work by Kim Whanki, Flying Birds ($434,500) and a version of Zhang Huan’s emblematic suite of nine photographic self-portraits with his face progressively obscured by Chinese brush calligraphy, Family Tree ($386,500), a new high for a work from this series.

Other top prices were brought for an exploded gunpowder drawing of two eagles by Cai Guo-Qiang ($422,500), a storybook-style painting of a boy with a giant red fish by Liu Ye ($362,000), a Socialist Realist satire by Wang Guangyi ($314,500), and a hyper-keyed image of a glamour girl by Feng Zhengjie ($242,500).

Sotheby’s sale of modern and contemporary art from India and Pakistan the following day, Sept. 18, 2008, totaled $7,845,500, with 82 of 126 lots selling, or just over 55 percent. Once again Subodh Gupta was the contemporary star, with his One Cow (2003), a 66 x 90 in. painting of a bicycle with several milk pails, selling for $866,500, just above the presale high estimate of $800,000.

Another high-priced contemporary lot included Thukral and Tagra’s "superflat"-styled Metropolis 1 dyptich from 2007, which sold for $182,500. The work was originally purchased by the seller in the same year it was made from Nature Morte in New Delhi. The artist’s action record, set in 2007 in Hong Kong, is $463,474.

For complete, illustrated results, see Artnet’s signature Fine Art Auctions Report.

dimanche 21 septembre 2008

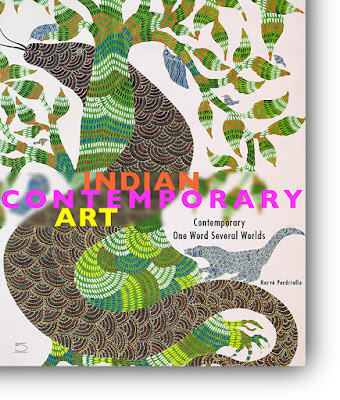

Where Is Indian Contemporary Art Today And Where Do We Go Next

By Peter Osborne. Source : indianartnews.com It is five years since I first started to collect and deal in Indian art and now is perhaps a suitable time to reflect on the state of the market as the Indian art boom moves on to its next phase.

First the good news. Indian contemporary art is in a great place, with many talented and provocative artists producing challenging, innovative artworks that are attracting attention from collectors around the world. Galleries and auction houses in Europe, USA, the Middle East, Hong Kong and elsewhere have generated huge interest in and demand for Indian art. The continuing growth of the Indian economy will feed through into the levels of personal wealth and cultural aspiration amongst Indians and NRIs that typically benefit the art market. It is a young market but maturing fast. Despite the global debt crisis and subsequent market turmoil art still seems to be attractive to buyers with recent strong auctions in India, London and New York.

Five years ago my Indian contacts gave me a list of the top ten artists that made up the “A List” and another 10 less important names who made up the “B List”. All the first ten were Modern Masters and only Gupta and a couple of other younger artists crept into the second group. I was flatly told that no one else mattered.

So we have come a long way since then, and any number of rising stars are selling for six figure dollar sums. There are literally hundreds of gallery shows and Indian art is starting to take its place on the international stage.

Auction houses in India and elsewhere are in a feeding frenzy and new artists are becoming established almost overnight with an insatiable competition to drive up prices and meet demand. The many funds investing in Indian art do not help to create market stability with aggressive, selective purchasing and erratic selling on a large scale. The comparative short term illiquidity of the art market is something that many collectors appear not to understand.

The Indian market has temporarily shifted in emphasis away from the Modern Masters towards younger contemporary artists. This is a global trend as new collectors seek out what is fashionable and ‘edgy’ and perhaps consider the Moderns as backward looking and a little dated. In the Indian context I don’t accept this, I reckon the trend has a lot more to do with investment returns, which used to be considerable for the Moderns but no longer are, whereas a fortuitous speculation in a young artist can generate a substantial short term return for the investor. So the gambler has simply moved to another table where the stakes are lower and the potential returns are higher.

Ultimately Contemporaries become Masters, but only very few go all the way and become permanently established. The rest stagnate and then fall back, sometimes quite quickly. This will happen to certain Indian contemporary artists from now on, especially those who do not have watertight, long term contracts with respected galleries inside and outside India, and ideally an international buyer base.

A huge amount of money is pouring into Indian art and it is no surprise that some of it is not being spent wisely. And as more and more artists ‘come of age’ so more and more will be discarded, and in my 25 odd years in this business one thing is for sure, the sharper the climb, the steeper the fall. True collectors are only interested in the visual and aesthetic qualities of their acquisition, price and investment value are very secondary. I sense that there are not yet too many genuine collectors in India and that the investor/speculator predominates. This is dangerous and likely to lead to tears and recriminations as buyers try to recycle their pictures and find that they have lost 50 or 75% of their value in a relatively short space of time.

Remember the auction house may be a market maker and may appear to underpin irrationally high price levels. But ultimately the auction house is an agent and will be happy to take a percentage at whatever price the artwork achieves, be it double or half the current level.

This state of affairs doesn’t just apply to Indian art. All the contemporary art markets are characterized by this trend. Very wealthy buyers might not care and will write off their purchases to indulgence. The Damien Hirst phenomenon is a perfect example of this. Everyone wants a piece of Hirst, and demand is almost limitless, regardless of any price/value ratio. The auction houses are brilliant at providing a buzz and excitement for purchasers who may regret their acquisitions in the cold light of day. In today’s world packaging and marketing are paramount.

So what would I like to see happen to Indian art.

I would like to see more good shows outside India.

I would like to see less decorative pictures with wishy-washy political messages and more edgy, controversial art works in more experimental media.

I would like to see more photography.

I would like to see more sculpture BUT properly cast and patinated. Cheap metal alloys do not look good and do not last.

I would like to see good original prints made by artists, small edition etchings and lithographs, NOT cheap reproductions of paintings.

I would like to see more non Indian art in India, which is now one of the world’s biggest art markets but virtually no museum or art gallery shows non Indian art.

I would like to see Indian art museums amount to something. Right now they don’t really count. All around the world visitors and connoisseurs head for the art museums to understand what is happening and to study historic trends. The Indian government should of course encourage donations with tax advantages but I somehow doubt this will happen in the short term.

I would like to see more attention being paid to pre-Independence Indian art. To paraphrase, to enjoy the shoots you need to understand the roots.

mardi 16 septembre 2008

L´Inde, le nouvel Himalaya du marché ?

Source : Art Market Insight [sept. 08]

Cette semaine, à New York sont orchestrés de nombreuses ventes thématiques dédiées au marché asiatique, devenu en moins de trois ans l´un des secteurs les plus porteurs.

Avec la Chine, l´Inde est l´autre prétendant à la direction du marché de l´art international. Au milieu des années 90, la forte croissance indienne fait émerger une nouvelle génération de mécènes prêts à investir dans l´art de leurs concitoyens. Aujourd´hui, la demande est mondiale et grandissante, portée par un climat très spéculatif aux possibilités d´allers retour alléchants. Les nouvelles étoiles de l´art indien sont disputées à Hong-Kong et Dubaï, Londres et New-York, New Delhi et Paris. Après la Chine, l´Inde apparaît comme un nouvel Eldorado pour les collectionneurs attirés par la spéculation.

Le sculpteur Anish KAPOOR, est une parfaite illustration de cette flambée des prix. Introduit pour la première fois sur le second marché dans les années 1980´ pour 15 400 €, l´artiste a vu sa cote prendre deux zéro de plus ces quatre dernières années, notamment par le biais de ses grandes sculptures en albâtre. Mesurant près de 2 mètres de haut, celle dispersée le 1er juillet 2008 à Londres est partie pour 1,72 m£ (2,2 m€). Désormais, certaines de ses sculptures miroir atteignent de tels niveaux de prix, à l´instar de Blood Mirror, un disque de 2 mètres adjugé 520 000 £ (789 000 €) en février 2007. La cote de Kapoor ne cesse de progresser depuis 2004, même sur les multiples. Par exemple, Blood Solid, un bronze laqué rouge tiré à 8 exemplaires, a été adjugé une première fois 80 000 $ en 2004. La version proposée deux ans plus tard chez Sotheby´s a trouvé acquéreur pour 92 000 £ (136 000 €) et celle dispersée cette année a atteint 250 000 $ chez le même auctioneer à New-York (162 000 €).

Autre élu de la scène artistique indienne, Subodh GUPTA âgé de 44 ans, était inconnu des salles des ventes internationales quatre ans plus tôt. Aujourd´hui, il est considéré comme le Damien Hirst indien en regard de sa notoriété, et ses prix flambent! En 2005, Sotheby´s dispersait sa toile Fisherman pour 13 000 $ (10 700 €). C´est à cette époque que le marchand Pierre Huber l´exposa sur son stand à la Frieze Art Fair. En 2007, les prix de ses toiles avaient largement décuplé pour s´échanger entre 130 000 et 280 000 € en moyenne ! Son succès est mondial : prisé à Hong Kong, Londres ou New York, il l´est aussi en France.

Les grandes maisons de ventes, Christie´s et Sotheby´s en tête, soutiennent le marché à un rythme de plus en plus soutenu en multipliant les ventes spécialisées. En France, le premier chapitre dédié à l´art moderne et contemporain Indien fut écrit par Artcurial le 3 décembre 2007, lors d´une vacation d´art chinois et indien. Il trouvait un écho favorable (1,4 million d´euros de produit de ventes) avec quelques succès notables, dont celui du jeune Manjunath KAMATH (1972). Son acrylique intitulée Teeth Politics (2007) achevée peu avant sa mise à l´encan, partait pour 36 000 €. Poursuivant sur sa lancée, Artcurial incluait de l´art indien dans sa vente d´art contemporain du 3 avril 2008 et déclassait le précédent sommet de Sudodh Gupta ! L´installation Vehicle for the seven Seas de Gupta obtenait en effet 425 000 €, plus de trois fois l´estimation… une enchère record portée par un collectionneur français ! Succès de courte durée, puisqu´un mois plus tard, à Hong Kong, Saat samundar paar (10), est partie pour 8 mHKD (651 000 €) et au 1er juillet 2008 une toile de 2005 s´est envolée pour 520 000 £ (657 000 €) à Londres chez Sotheby´s.

L´une des grosses surprises de l´année 2007 est le jeune Raqib SHAW, dont Garden of earthly Delights III s´est totalement envolé à hauteur de 2,4 m£ (3,45 m€) à Londres le 12 octobre, établissant un record pour une œuvre d´art contemporain indien. Il faut dire que cette pièce majeure avait un bon pedigree. Acquise à la Victoria Miro Gallery en 2004 elle avait été exposée au MoMA (NY) en 2006.

D´autres artistes indiens sont en train de prendre d´assaut les premières places dans le classement des artistes actuels les plus cotés. Le 20 septembre 2007, le peintre Atul DODIYA a décroché une enchère de 450 000 $ (322 000 €) pour Three Painters. Introduit depuis 2006 aux enchères, Bharti KHER a vu, en avril 2008, l´un de ses paysages s´arracher 165 000 £ (209 000 €) à Londres, pour une estimation de 40 000 – 60 000 £. Un mois plus tôt, un diptyque de TV SANTOSH est partit pour 280 000 $ (178 000 €) chez Christie´s New York. Parmi les autres résultats à 6 chiffres enregistrés, signalons encore celui de Shibu NATESAN pour l´équivalent de 113 000 € et de Jitish KALLAT, 105 000 €, décrochés en mai dernier à Hong Kong.

Dopée par des ventes spécialisées, la cote de l´art contemporain indien affiche une progression impressionnante : en juillet 2008, on enregistrait un indice des prix en hausse de +3 230% sur la décennie !

dimanche 14 septembre 2008

New Delhi, nouvelle capitale de l'art

Source : Les Echos New Delhi est devenu une capitale de l'art au même titre que Londres, New York ou Paris. La preuve ? L'un des artistes vivants le plus cher au monde y expose ses créations. « Sotheby's va exposer une sélection d'oeuvres du fameux artiste et sculpteur Damien Hirst à l'hôtel Oberoi de Delhi avant une vente aux enchères », qui aura lieu mi-septembre à Londres, explique le quotidien « The Times of India ». Pour Sotheby's, le choix de l'Inde s'est imposé assez naturellement à cause de la mondialisation du marché de l'art. En 2003, les gros clients de Sotheby's venaient de 36 pays différents. Aujourd'hui, 58 nationalités constituent la clientèle privilégiée de la maison britannique. Et parmi ses nouveaux collectionneurs, le nombre d'acheteurs indiens lors des enchères a doublé entre 2004 et 2007.

Oliver Barker, un spécialiste de l'art contemporain de Sotheby's, a déclaré que cette expérience servirait d'enseignement pour la société de vente aux enchères, expliquant que cette passion soudaine pour l'art contemporain en Inde était en partie due au succès d'artistes locaux tels que Raqib Shaw ou Subodh Gupta. Le quotidien indien rapporte ainsi qu'une « oeuvre de Shaw, «Le Jardin des délices III», s'est vendue pour 3,3 millions d'euros en octobre dernier, un record pour une oeuvre indienne lors d'une vente aux enchères ». Barker estime également que cette exposition est « par de nombreux aspects, la plus importante en Inde pour un artiste étranger ». Toutefois, selon Sotheby's, les collectionneurs indiens sont encore dans une phase de découverte de l'art occidental. Ainsi, les quatorze oeuvres de Hirst qui sont exposées ont été choisies parmi plus de 200 créations pour être susceptibles de plaire à un public local. Pas question, donc, de trouver les cadavres d'animaux conservés dans du formol que Hirst expose dans des aquariums dans le cadre de sa réflexion sur la vie et la mort. Non ! il s'agira plutôt de ses peintures avec des papillons naturalisés, de ses toiles faites de points de couleur et de ses sculptures agrémentées de diamants.

samedi 6 septembre 2008

vendredi 5 septembre 2008

The Success Story of India's First International Art Fair

Source : Gather.com

The recent Art Summit was the Indian art scene’s attempt to climb a new rung in its international aspirations, says NISHA SUSAN

An astounding 10,000 art enthusiasts walked in to witness India’s First International Art Fair, India Art Summit(TM) 2008, firmly establishing it as a one stop destination for art in India. With an overwhelming mix of art collectors, artists, critics, curators, students and art enthusiasts from across India and overseas, the Summit achieved exactly what it set out to - making art, and the knowledge of art, accessible to a widespread audience.

Commercially speaking, the fair clocked in a record sale of approximately 50%, with the 34 participating galleries selling over 280 artworks worth Rs.10 crores approximately. Given that the total value of the 550 artworks on display was approximately Rs. 20 crores, India Art Summit has emerged as one of the most successful first editions of any art fair across the world.

With all eyes now on India, event producers Hanmer MS&L, have announced plans to schedule India Art Summit 2009 between 19th - 22nd August’ 2009 in New Delhi. Next year, the fair is proposed to be over three times bigger and applications are already pouring in from across India and world. While in the first year, the focus was largely on Indian art and Indian galleries, the second year will see participation from galleries across the world showcasing a sizeable array of artworks from different parts of the world.

Ashok Art Gallery is a five-yearold Delhi gallery that largely functions online. A mom-and-pop operation with a handful of unknown artists, Ashok Art Gallery has never had any exposure in the media. Their only previous art fair experience was with the Mumbai art expo earlier this year. As one among 35 galleries that participated in the recent India Art Summit (between August 22 and 25), Ashok Art Gallery did not expect to become frontpage news. But their 27-year-old Oriya artist Kanta Kishore’s marble sculptures of rolled-up newspapers were sold within hours of the fair’s opening. Gallerists Ashok Nayak and Kavita Vig, Kavita’s husband Bharat and septuagenarian mother-in-law watched astonished as the art young Indian superstar Subodh Gupta and politician Maneka Gandhi came to their stall. And in their wake, thousands of visitors and the press.Sculptures and installations sold almost as well as paintings, signalling a new trend. The panel of speakers and choice of topics at the Art Forum also drew many accolades and was deemed as amongst one of the best such initiatives of its kind, internationally.

Mr. Sunil Gautam, Managing Director, Hanmer MS&L commenting on the fair said, “It is great to see that India Art Summit has emerged as the most inclusive collaborative art platform in India in it’s very first year. We believe that this initiative is a step in the right direction to put India on the global art fair circuit.”

Commenting on the success of the fair, Mr. Philip Hoffman, Chief Executive, The Fine Art Fund said “The Indian market is very important in the global art scene and this fair is a major step. I can imagine this to be major fair in Asia competing alongside London, Miami and Basel in the next 5-10 years. The sales results of the fair seemed very impressive by comparison to other fairs in their first year.”

India Art Summit - Backgrounder

The art fraternity in India has for long felt a gap and the need for a collaborative industry platform in the country owing to the phenomenal growth and global interest in Indian art. While the art fraternity the world over gets numerous opportunities to interact and collaborate through various art fairs, biennales & expos, there was no such platform in India. Therefore the time was right for India to offer a suitable platform for art. The initiative has received invaluable recognition and endorsement from the Ministry of Culture, Government of India and Sotheby’s.

The Summit hopes to achieve the dual purpose of, on one hand, serving as a window for International collectors to get a single access point to Indian art and, on the other, exposing the Indian collectors to a range of global Art that will be showcased at the fair in the coming years. More than just a place for buying and selling art, this initiative will enable diverse stakeholders from India and around the world to come together and discuss the creative and commercial aspects of Indian art.

Today, Indian art is greatly appreciated both internationally and within the country, annually growing at 30-35%, the Indian art market is currently worth Rs 1500 crores. The Indian art market has gone up by 485 percent in the last decade making it the fourth most buoyant art market in the world. The total auction market size of Indian art has changed from US $5 million in 2003 - just five years back - to nearly US $150 million this year.

Saffronart auction: Indian art sets 18 world records

Source : ECONOMICTIMES.COM by Arunava Biswas

NEW DELHI: Saffronart closed its exciting Autumn Online Auction of Contemporary Indian art on Thursday, registering a total sale value of approximately Rs 29 crores ($7.2 million), about 72% in excess of the low estimate.

At the sale, world auction records were set for 18 Indian artists, including T V Santhosh, Anju Dodiya, Sudhir Patwardhan, G R Iranna, Mithu Sen, Anita Dube, Sudarshan Shetty, Anil Revri, Tushar Joag, Manisha Parekh, Debanjan Roy, Phaneendra Nath Chaturvedi, Kishor Shinde, Chitra Ganesh, Ravikumar Kashi, Ram Bali Chauhan, Mayyur Kailash Gupta and Nicola Durvasula.

The sale featured several genres of contemporary Indian art including painting, sculpture, photography and installation. Contemporary artists are increasingly gaining more strength in auctions. Together with Chinese and Southeast Asian art, Indian works of from this genre is witnessing tremendous growth.

While US contemporary art is leading the pack, this genre is sweeping the world and younger artists are establishing a connect with the recent global art trends.

Over 575 registered bidders from all over the world competed against each other for the works of some of India's most talented artists. The top five lots of this Saffronart auction were Subodh Gupta’s 'Idol Thief I', selling for Rs 4.28 crores ($1.07 million); Subodh Gupta's 'Saat Samundra Par' (Across the Seven Seas), selling for Rs 3.4 crores ($850,000); T V Santhosh's 'When your Target Cries for Mercy', selling for Rs 2.8 crores ($701,500); Anju Dodiya's 'The Site', selling for Rs 1.06 crores ($267,375); and Sudhir Patwardhan’s 'The Clearing', selling for Rs 93,15,000 ($232,875).

Within the first hours of the auction, several lots crossed their higher estimates, including T V Santhosh’s diptych, featured on the cover of the catalogue, and works by Subodh Gupta, Riyas Komu, Anandajit Ray, G R Iranna, Tushar Joag, Dhananjay Singh and George Martin, setting the pace for the exciting bidding activity that continued till the last seconds of the sale.

NRIs and domestic collectors are getting increasingly active at international auctions of Indian contemporary art. While old buyers are picking up pieces occasionally, there is a fair cross-section of newer collectors who have entered the field.

lundi 1 septembre 2008

Devi Art Foundation Opens New Exhibition Space in India

Source : Artdaily.org GURGAON.- The Devi Art Foundation is one of the first not-for-profit spaces dedicated to showcasing contemporary art from the Indian Subcontinent. It has been established to facilitate the viewership of creative expression and artistic practice that exist in the region. It is envisioned as a space that will enable wider audiences to interact with cutting edge and experimental art works.

Devi Art Foundation's inaugural exhibition is entitled 'Still Moving Image'. 'Still Moving Image' is the first in a series of upcoming exhibitions, curated out of the Lekha Poddar and Anupam Poddar collection. It shows a selection of video and photography compositions by 25 Indian artists namely Aastha Chauhan, Atul Bhalla, Avinash Veeraghavan, Baptist Coelho, Bharti Kher, Kiran Subbaiah, Mithu Sen, Nalini Malani, Navin Thomas, Pushpamala N., Ram Rahman, Rameshwar Broota, Ranbir Kaleka, Ravi Agarwal, Sheba Chhachhi, Shilpa Gupta, Sonia Khurana, Sudarshan Shetty, Surekha, Susanta Mandal, Tejal Shah, Tushar Joag, Valay Shende, Varsha Nair and Vivan Sundaram.

The Devi Art Foundation is committed to providing a space for young artists experimenting with new ideas, without the imposition of commercial limitations. For a comprehensive engagement and understanding, a series of lectures, talks and artists' interaction will be designed around each exhibition. This initiative aims to develop and foster dialogue and relationships between the artists, art critics, curators, collectors, gallerists, and a larger audience segment.

The Devi Art Foundation plans to articulate its objectives through the curated exhibitions that will be mounted at the Foundation space. The Foundation is located on the premises of a corporate office with an area of 7500 square feet. The programme will focus on a limited number of exhibitions each year, which will be on view for a substantial period to allow the general public time to engage with the exhibits.

The Lekha and Anupam Poddar collection will serve as the basis for initiatives and experiments undertaken by curators. It is hoped that the exhibitions will pose questions, present responses and provoke thought, and maybe even action, with their selection of works, exhibition design and the texts generated around the exhibition. By presenting art from all over the Subcontinent, the exhibitions of the Foundation hope to re-invoke the sense of a shared history within the region.

As one of the most comprehensive compilations of contemporary art in India, the Lekha and Anupam Poddar Collection is comprised of significant artworks in media as varied as painting, sculpture, interactive installation, video, and photography, reflecting the collectors’ cross-disciplinary interests. Even as representations of India’s folk and tribal traditions have been integrated into the core of the collection, other countries in the Sub-continent such as Pakistan, Sri Lanka, Bangladesh, Afghanistan, and Tibet have a growing and substantial voice.

Archives revue de presse

-

▼

2008

(97)

-

▼

septembre

(9)

- FEATURE-Indian art offers high appreciation in vol...

- Art Market Watch

- Where Is Indian Contemporary Art Today And Where D...

- L´Inde, le nouvel Himalaya du marché ?

- New Delhi, nouvelle capitale de l'art

- Alok Bal, water colour on paper, 18 x 24 inches, 4...

- The Success Story of India's First International A...

- Saffronart auction: Indian art sets 18 world records

- Devi Art Foundation Opens New Exhibition Space in ...

-

▼

septembre

(9)