lundi 20 octobre 2008

Art markets decline after financial crash

Source : The Economic Times KOLKATA by Ashoke Nag: There’s little doubt that the global financial meltdown has dented the art market to a degree. Historical data suggest that art markets declMore Pictures

ine 6-12 months after a financial crash. However, in the present debacle, the reaction seems to have been quicker.

The downswing in the art scene, however, has also extended opportunities to the avid collector to lap up quality works of modernist masters and heritage artists from, for instance, the Bengal School of Art at prices lower than the highs achieved during the boom time.

Mr Nirmalya Kumar, a top UK-based art collector and professor of marketing at the London Business School, told ET: “The September 2008 auctions by Sotheby’s and Christie’s in New York did not fare too badly. But, the recent auction of Indian and Islamic art in London clearly indicates that the crisis is taking its toll. Not only were a number of lots left unsold, many of them either fell short of the minimum estimate or just touched the minimum level. I managed to pick up a beautiful Francis Newton Souza for just £5,000. From an investment angle, one should definitely avoid acquiring contemporary artists, who have ascended dramatically over the past 24 months. There’s every possibility that their prices could fall in the next six months.”

The positive side of all this, Mr Kumar said, is that the top-quality works of modern masters, such as Souza, Husain and Raza, will retain their value. At the same time, heritage artists, including those from the Bengal School like Rabindranath Tagore, Jamini Roy and Nandalal Bose, should maintain their value because they have risen steadily and their supply is limited.

“The second quality works of the modernists, however, have seen a decline.” “You can cherry pick, but one shouldn’t buy with the thought that prices will rise significantly in the short run. One should buy what is likable and look at a longer holding period. It’s difficult to predict the direction that the March 2009 auctions of Sotheby’s and Christie’s will take. They are six months away. I’ll be surprised if there is sizable price rise,” Mr Kumar added.

“The NRI fraternity abroad was largely buying Indian art for investment. Only a few, probably, harbour the collector’s psyche. These collectors may take the opportunity to buy works at these depressed prices,” Mr Prakash Kejariwal, collector, art specialist and director of Chitrakoot, Kolkata’s oldest art gallery, said.

“Back in India, those who were investing their surplus share market funds in art will discontinue this pursuit for the time being. There are only a few collectors who don’t depend on the stock market to buy art. But this community is limited. So, the market is bound to shrink and prices could plateau.”

Mr Kejariwal also underscored that quality works of progressives and modernists like Ganesh Pyne, Bikash Bhattacharjee, Somnath Hore, Jogen Chowdhury and Rameshwar Broota are definite buys. In tandem are the old masters like Raja Ravi Verma. Buyers could also go for sculptures, which still enjoy price elasticity. “We must understand that art prices don’t collapse like share tags do. Art is not quoted in the markets as shares are,” Mr Kejariwal said.

Vikram Bachhawat, a well-known gallerist who heads Aakriti Art Gallery and is also the director of Emami Chisel Art, said he has been interacting wiMore Pictures

th people in Mumbai and Delhi and most collectors have shown an interest in sourcing art.

“But, investors want to wait and watch. Some new investors are viewing art as an alternate avenue. At the moment, investors are focusing on auction-listed artists, who number around 300. At the same time, average artists will be glossed over in this market. If fund houses start ploughing money into art, the market, pegged at Rs 1,500-2,000 crore now, will expand at least three-fold.”

“The art market has been under pressure for the past eight to nine months, even before the stock markets crashed. Art works, both high and medium value, have slipped by 25-30%. Someone with liquidity can easily go for high quality modernist works with a long-term perspective. These pieces are available now at 35-40% below the market price a year ago. It’s the right time to buy if one chances upon a good piece. One should look at a timeframe of three to five years while making such an acquisition, though,” Abhijit Lath, collector and director at Akar Prakar Gallery, said.

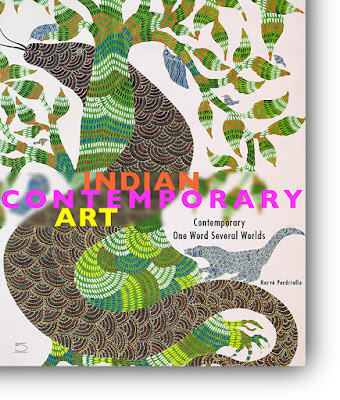

Herve Perdriolle, Indian art consultant at leading French auction house Artcurial, hinted at some optimism: “Many factors should make the Indian market, particularly in these depressed stock market times, a favourite destination for investors and collectors. The Indian market is only about 0.1% of the international market. Compared with 45% of the market share held by the Americans, we can easily imagine a high-growth margin for the Indian art market.”

jeudi 16 octobre 2008

Pas de panique

Le marché à la veille de la Fiac. Source : Challenges

En dépit du sombre état de la finance mondiale, le marché de l'art se porte plutôt bien. Russes et Indiens ont remplacé les collectionneurs américains.

Alors que la 35e édition de la Fiac (lire ci-contre) s'apprête à ouvrir ses portes à Paris, les acteurs du marché de l'art ne peuvent évidemment rester indifférents à la tornade qui secoue l'ensemble des marchés financiers. Pessimistes ? Le mot ne convient pas dans ce milieu feutré où l'on veut toujours croire, sinon au miracle, en tout cas à la spécifi cité d'un marché qui mêle passion et argent. Et de citer, pour commencer, un exemple rassurant : les 15 et 16 septembre, à Londres, la vente organisée par Sotheby's réunissant plus de 200 oeuvres de Damien Hirst a fait un véritable malheur.

Les 118 lots (sur 223) ayant trouvé preneur ont réalisé un produit total de plus de 140 millions d'euros. Détails d'importance : pour la première fois, c'est l'artiste qui proposait à la vente ses propres oeuvres, et non la galerie. Plus étonnant : la vente a eu lieu alors que Wall Street et les Bourses européennes entamaient leur descente aux enfers. Quelle conclusion tirer de cet incroyable succès ? Pour Guillaume Cerutti, PDG de Sotheby's France, cet épisode est significatif de «la grande vitalité du marché de l'art». Car si les acheteurs américains ont été absents de cette vente, le relais a été pris par des collectionneurs européens - Russes, entre autres - et asiatiques - Indiens notamment. De toute manière, ajoute Guillaume Cerutti, «la crise des subprimes ne date pas d'hier, puisqu'elle remonte au coeur de l'été 2007. A l'heure actuelle, celle-ci n'a eu aucune incidence sur notre activité. Pour la France, le montant de nos ventes pour le premier semestre 2008 est en progression de 104% par rapport à la même période de l'année 2007». Les prévisions sont-elles aussi optimistes ? «Notre horizon, commente prudemment Guillaume Cerutti, va d'une vente à l'autre.»

Un point de vue largement partagé par Francis Briest. Le vice- président d'Artcurial reconnaît qu'il «risque de se produire des turbulences. D'expérience, nous savons que dans les périodes difficiles, les acheteurs occasionnels sont moins présents». Et d'ajouter que si certains gros acheteurs risquent de se montrer plus raisonnables, «les piliers seront toujours là». Il n'empêche, les piliers risquent de ne plus être les mêmes. Les regards se tournent désormais vers ceux que l'on appelle encore les «pays émergents» - pays du Golfe, Inde, Chine, Russie et républiques de l'ancien bloc soviétique. Ce n'est pas un hasard si, dans le cadre de la préparation de la vente Damien Hirst, un certain nombre de ses oeuvres ont été exposées plusieurs jours durant en Inde...

Pas de panique donc sur le marché de l'art. Mais une vigilance renforcée. On sera par conséquent très attentif aux ventes organisées à Paris par Artcurial durant la Fiac - ventes d'une collection de dessins et vente d'art moderne les 23 et 24, vente d'art contemporain les 27 et 28 octobre. Entre des oeuvres de Bonnard, Van Dongen, Matisse (pour un très beau fusain sur papier de 1938, Femme nue allongée, estimé entre 300 000 et 400 000 euros), on trouvera même une oeuvre signée Damien Hirst : cette encre de chine sur papier intitulée Cradle to the Grave est estimée entre 3 000 et 4 000 euros. Pas de folie ici, donc. Paris est une ville sage.

samedi 11 octobre 2008

Financial firms cash in on art boom

Madhumita Mookerji / Source : DNA MONEY

Kolkata: The canvas is significant though not particularly large at present. But, especially at a time when stock prices across the world are falling sharply, many strongly feel art is not just for art’s sake but a sound alternate investment option.

Several players — Edelweiss Securities, Bajaj Capital Art House (BCAH) and Art Vibes — are homing in on this potential by offering what is being regarded as art advisory services and portfolio management.

Edelweiss Securities, for instance, introduced an art fund through Yatra Funds and since January 2008, has tied up with Copal Arts to design portfolios in which art lovers and collectors can acquire quality works of artists.

Similarly, Bajaj Capital Art House, launched in August, offers art investment advisory, evaluation of art pieces, authentication certificates, fine art insurance, art restoration and art resale services.

Art Vibes has a strategy to provide portfolio management services for the private and corporate collector. “A wide variety of opportunities would include art collection advisory, valuation and appraisal, documentation and storage, auction representation, cataloguing, restoration and conservation, education and outreach programmes and sponsorships,” said Aashu Maheshwari, head of Art Vibes.

BCAH also provides services in branding requirement of visual artists through promotions, branding and representations etc.

Anurag Mehrotra, head of wealth management, Edelweiss Securities, said, “The Indian art market, though at a very nascent stage, finds connoisseurs worldwide and the numbers are increasing. The valuations are fairly low compared with international art pieces. In terms of market size, the Indian art market is only about 0.1% of the international market. So, the potential for growth is huge.”

In the mid-90s’ Indian art auctions were held in London and New York. Slowly but steadily, art is enlarging its canvas in India, with new galleries being set up in Bangalore and other cities. “Art was viewed as a status symbol. But post 2000, it has emerged as an investment option. Now, it is being considered as a separate asset class,” said Anu Bajaj, chief executive officer, BCAH.

The Indian art market is today valued at about Rs 1,500 crore growing at 30-35% annually. But what are the pitfalls? “The art market here is not regulated. Though Sebi and the government have taken some steps to improve efficiencies like introducing ban on collective investment schemes in art works, the market needs to mature like equity markets,” said Mehrotra.

“We don’t see any big risks yet but yes there are concerns like liquidity, transparency mechanisms, fake art works.”

mardi 7 octobre 2008

Pop Goes the Bubble in Chinese & Indian Art

Fallout from the global economic crisis hits the opening sale of modern and contemporary Asian art at Sotheby's in Hong Kong. Source BusinessWeek

While much of Hong Kong hunkered down just hours before the arrival of a typhoon on Oct. 4, the start of Sotheby's three-day auction of modern and contemporary Asian art was buffeted by the financial storm on Wall Street. Of the 47 works that went under the hammer, more than 40% were unsold. What's more, earnings for Sotheby's (BID), including the auctioneer's commission known as the "buyer's premium," were a paltry $15 million, accounting for just 41% of the auction house's estimated takings for the night. Among the biggest upsets was the unsold work by India's hot-selling artist Subodh Gupta, Untitled, which had an estimated price of $1.55 million to $2.05 million. Another big surprise: Chinese cynical realist painter Liu Wei's triptych, The Revolutionary Family Series, failed to find a bidder willing to meet the $1.55 million suggested minimum.

As the weather deteriorated on Sunday morning, so did events in the auction hall. Only 39 out of 110 paintings from the 20th Century Chinese Art Sale found buyers, while 71 had to be packed up and shipped back to their sellers. By the afternoon session, the usual buzz at Hong Kong's contemporary Chinese art auctions was sorely absent. At one point during the sale, the auctioneer mistook a woman covering her mouth to stifle a yawn for her wishing to bid, prompting a valiant attempt to inject some levity into the proceedings as he asked if "anyone else is yawning in the room."

Yawns gave way to disbelief a little later when two works by white-hot Chinese artist Zhang Xiaogang went unsold. That's a huge reversal for the Beijing-based artist, whose paintings have routinely fetched millions of dollars, well in excess of auction estimates. (His painting Bloodline: Big Family No. 1 was one of the few top lots that sold on Saturday, though the $2.97 million price was below the expected maximum.) Yue Minjun and Zeng Fanzhi, two others among the hottest-selling Chinese contemporary artists, did manage to sell, although well within the estimates.

Wall Street Fallout

You connect the dots: Wall Street goes into meltdown, and Sotheby's auction bombs in Hong Kong. Kevin Ching, Sotheby's CEO for Asia, tries to be optimistic about whether the two are connected. "I hope there is no immediate direct correlation between the financial market and the art market," he says, pointing to the widely successful auction of enfant terrible Damien Hirst's works in London within days of the collapse of Lehman Brothers. The problem with some of the Hong Kong auction, he adds, stems from overly ambitious owners trying for unreasonably high prices. "When we have [sellers] who want aggressive estimates over and above what [the] market can accept, they would have to occasionally accept the consequences, and I think that's what happened here [Saturday] night," Ching explains.

Still, others in Asia's art business are certain the fallout from Wall Street is already hurting Chinese and Indian markets. In both countries, newly wealthy investment bankers and hedge fund managers helped inflate bubbles (BusinessWeek, 6/5/06) in works by local artists. For instance, in the last four years a booming Indian economy (BusinessWeek, 6/5/06) and buoyant stock market encouraged many private banks to offer fee-based services to assist clients in building portfolios of artworks sourced from galleries, auctions, and even direct sales. Fund managers say that investment bankers with their hefty bonuses helped inflate art prices by 30% to 60% above their real value, according to a gallery owner in Mumbai.

Bright Spots

Now with Wall Street in turmoil, most of the bankers who were regulars at art shows and auctions have moved out, says avid art collector Harsh Goenka, chairman of India's diversified RPG Enterprises, which has interests in tires, power, and retail. He claims that in the last few years, around 60% to 70% of art sold in auctions and shows in India went to the new breed of investor rather than art connoisseurs. "They looked at art as a brand and made money by trading in it," says Goenka. In the past few months, he says, painters and art dealers have been calling him up to offer their unsold works at a 30% to 40% discount.

The picture isn't all grim, though. The mood was positively ebullient at Sotheby's Hong Kong on Oct. 6 as buyers crammed the room for the auction of Southeast Asian contemporary paintings. Sotheby's employees manned the phones to handle enthusiastic overseas bidding. For instance, Indonesian painter I Nyoman Masriadi had already set a personal record on the first day of the Sotheby's auction when his huge canvas featuring Batman and Superman sitting on adjacent toilets sold for $620,000. He then surpassed that with a painting of boxers that seems part Botero, part Léger; it fetched a high $833,000. A bit later, during furious bidding for yet another Masriadi, the auctioneer exclaimed "This is really, really fun." The room broke into applause when the work finally sold for a very respectable $307,000.

The reason for this sea change in sentiment? The prices were far more affordable than the works from China and India on sale during the weekend, and collectors seem to have finally cottoned onto the notion that Indonesian, Vietnamese, and Filipino artists represent opportunities for collectors to own great art. One work by up-and-coming Filipino painter Geraldine Javier sold for $32,000, more than three times the high estimate. An intimate portrait of a woman and child by Vietnamese painter Mai Trung Thu also sold for triple the estimate, fetching $23,000.