Source Herald Tribune These are painful times for Indian tycoons, as indicated by the most recent Forbes Asia Rich List. A falling stock market, a weak rupee and slowing economic growth have shaved about 60 percent off the wealth of the 40 richest people in the nation, Forbes said in its annual compilation earlier this month, with their net worth plunging to $139 billion from $351 billion a year ago.

"They're definitely feeling the pain," said Sonu Bhasin, president of retail finance at Axis Bank and head of the bank's private banking and wealth management divisions, which have nevertheless continued to add new clients in recent months.

"Everyone's hurting, everyone's in a panic, but the wealthy get noticed more and their concerns get addressed."

An economy that grew at about 9 percent in each of the past three years and a six-year bull run on the stock market helped mint new millionaires in one of the largest economies in Asia, a rich class that purchased luxury cars, yachts and sprawling vacation homes.

India had 123,000 millionaires in 2007 and showed the fastest pace of expansion, a Merrill Lynch/Capgemini report said.

But a stock market rout has meant local investors have "notionally lost almost a year's GDP," Credit Suisse said in a recent report titled "Wealth destruction aftermath."

Bhasin's clients, who are high net-worth individuals, are seeking more professional advice and also favoring more traditional investment options, like bank deposits, she said.

"They are seeking safety: Fixed deposits are making a huge comeback, and there is also some interest in gold. We've always told clients making money is a boring exercise. Now they're being more realistic and willing to be bored."

The reality is harsh for the Indian steel baron Lakshmi Mittal, chief of Arcelor Mittal, the world's top steel maker, who gave up his No. 1 position on the Forbes list because of crashing prices. The new No. 1, Mukesh Ambani, chief of the top private Indian company Reliance Industries, has a net worth of about $21 billion, Forbes estimates, down 58 percent from last year.

The loss does not seem to have affected the construction of his $1 billion home on Altamount Road in Mumbai, among the most expensive stretches of residential real estate in the world, even though other luxury apartments in the city are finding few takers.

For homes costing more than 100 million rupees, or $2 million, "demand is very weak because it is linked to big bonuses and stock market returns, which have taken a hit," said Abhisheck Lodha, a director at Lodha Group, a developer in Mumbai.

Real estate tycoons like Kushal Pal Singh of DLF have seen the biggest wealth erosion this year, Forbes noted, while the founders of the windmill maker Suzlon have lost their billionaire status and the liquor baron Vijay Mallya, head of the United Breweries Group, has dropped off the Forbes list because of losses to his Kingfisher airline.

"Business founders were the worst hit as the largest shareholders," said the Credit Suisse report, which estimated that the top 20 business groups in India had lost about 71 percent of the value of their listed investments, or $226 billion, this year.

But while the notional value of their wealth has taken a hit, Indian billionaires still have plenty of loose change for luxury cars, art and wines. Sales of cars priced at more than 2 million rupees have remained strong, bucking the slump in overall Indian car sales.

Car sales fell nearly 7 percent from a year ago in October, but Mercedes-Benz has already met its full-year target, with a 47 percent increase, and sales by Bayerische Motoren Werke, or BMW, have more than doubled.

Neville Tuli, the chairman of Osian's, a leading auction house, is confident that there will be bidders at a coming auction of Indian art and crafts even "in a worst-case scenario." At auctions in New York recently, sales were less than half what they were a year ago and a majority of works were offered at prices far below their presale estimates.

"The Indian economy is stronger than the economies of Europe and the United States, so our art market's stronger," said Tuli, noting there were several new guests at the recent preview. "The art market's really dependent on collectors who, irrespective of what is happening in the rest of the world, will still allocate resources to art. That's their first priority."

As for premium spirits, demand is strong, said Vishal Kadakia, an executive at the importer Wine Park and de facto head of the Bombay Wine Club. "The alcohol industry is probably the most recession-proof," he said. "When times are bad, everyone wants a drink."

mercredi 26 novembre 2008

Indian tycoons feel the pinch from the downturn

Osian’s to auction historical works

Source : Economic Times Top art auctioneer Osian’s is coming up with a sale of the modern and contemporary art and craft of India for the first time. The auction

on 27 November in Mumbai will see a spread of historically significant masterpieces of fine art and a pick of contemporary crafts.

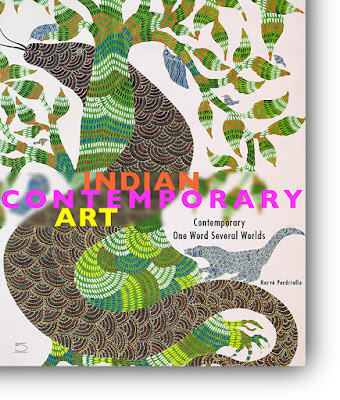

The auction comprises 159 lots which sport a total lower estimate of around Rs 31 crore. The auction’s menu includes iconic works by the Tagores, Amrita Sher-Gil, MF Husain, SH Raza, VS Gaitonde, Sadequain, Ganesh Pyne and Akbar Padamsee among others. The auction is also focusing on artists such as Hemen Mazumdar, GR Santosh, J Sultan Ali, Arun Bose, Nagji Patel, Paresh Maity and Shobha Broota.

With the genre of crafts featuring in the auction, the sale is also unveiling a section on how the folk and craft tradition has inspired the fine arts with works by Jamini Roy, J Sultan Ali, K Laxma Goud, KG Subramanyan, S Nandagopal and PV Janakiram among others.

The auction will also encompass select works from The Camlin Collection such as a rare impasto driven painting by MF Husain, tracing back to 1970 and other works such as Village Scene dated 1974 by NS Bendre and The Pond which was created by Bikash Bhattacharjee in 1995.

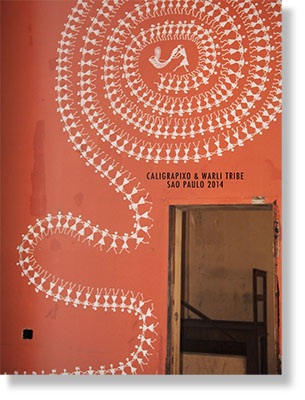

“We are now initiating the process of promoting contemporary crafts with a fine selection of works from the paramparik karigar –– ‘craftsmen’. The range consists of bronze pieces, stone carvings, pattachitra and palm leaf etching from Orissa, gond paintings from Madhya Pradesh, warli paintings from Maharashtra and phad from Rajasthan. In these lots are also mata ni pachedis from Gujarat, West Bengal’s pattas, banarasi and gujarati sarees and kalamkari from Andhra Pradesh.

One of the highlights is pabhuji ka phad, a unique phad painting which was awarded the National Merit Award by the Development Commissioner of Handicrafts in 2006,” Ms Neeti Mallick, vice-president, auction house, Osian’s Connoisseurs of Art, said in an email to ET.

Ms Mallick added, “In the present volatile financial market, high quality fine art probably provides a stable asset which holds and sustains its value with greater consistency than any other financial instruments. The Osian’s collection in our upcoming auction presents high quality artworks for the seasoned and emerging collector. Even in today’s financial situation, there is a great demand for rare and historically significant artworks. We are optimistic that the artworks and crafts will achieve their financial respect.”

lundi 24 novembre 2008

Craft of the Matter

Source : ExpressIndia Georgina Maddox

Thanks to the meltdown, traditional craft finds a place next to modern art at Osian’s auction

Come November 27 and the works of traditional craftsmen will go under the hammer along with paintings of Amrita Sher-Gil and SH Raza. The upcoming Osian’s auction in Mumbai, which is focussing on crafts when art auctions are taking a beating due to the looming recession, will familiarise art lovers with names like Laxmanan, Jaidev Baghel, Moti Karn and Kalyan Joshi of the Paramparik Karigar.

“This auction will be a step towards promoting the traditions of India and creating a conducive environment for craftsmen. In times of recession, it helps to diversify one’s portfolio,” says Neville Tuli, chairman of Osian’s Connoisseurs of Art. It will be a step forward for Paramparik Karigar, a well-known organisation formed by craftsmen to promote the traditional crafts of India. There will be a selection of its works, including bronze pieces, stone carvings, Patachitra and palm-leaf etchings from Orissa, Gond paintings from Madhya Pradesh, Warli paintings from Maharashtra, Phad from Rajasthan and Patuas from Bengal. One of the Phad paintings bagged the National Merit Award by the Development Commissioner of Handicrafts in 2006.

Osian’s has also dedicated a section to fine arts that have been inspired by folk and craft traditions, by including works of Jamini Roy, J Sultan Ali, K Laxma Goud, K G Subramanyan, S Nandagopal and PV Janakiram. The auction comprises 159 lots and is valued, at a low estimate, at around Rs 31 crore. It also includes rare works by Rabindranath Tagore, MF Husain, VS Gaitonde, Sadequain, Ganesh Pyne and Akbar Padamsee. As part of the fine arts section, select works from The Camlin Collection, such as a rare impasto-driven painting by Husain, dated 1970, and other works such as Village Scene (1974) by N S Bendre and The Pond (1995) by Bikash Bhattacharjee have been included. “Even in today’s financial situation, there is always demand for rare and historically significant works,” says Neeti Mallick, vice-president, Auction House of Osian’s.

samedi 15 novembre 2008

The remarkable renaissance in Chinese art

More than half of the world's best-selling painters and sculptors today are from Asia – a major shift after 500 years of domination by Western art. Andrew Johnson reports. Source : The Independent

With its £2 trillion surplus, China's economic might dominates the world. Now its painters and sculptors are developing, collectively, into a contemporary arts superpower. Asian artists, and in particular those from China, dominate a new list of the world's best-selling contemporary artists of last year. Among the world's most sought-after artists are the unfamiliar names of Zhang Xiaogang, Yue Minjun and Zeng Fanzhi.

Of the world's 20 top-selling artists, 13 are from Asia, with 11 coming from China. Asian artists make up six of the top 10 biggest sellers at auction, five of which are Chinese. Experts predict that within a decade, the term "Asian art" will be as widely used as "Western art" and will be responsible for most global sales.

The annual survey of the global art market by the auction tracking site Artprice and the Axa insurance company lists the 500 top-selling artists at 2,900 auctions between July 2007 and June 2008. While the top four selling contemporary artists at auction were the Western superstars Jeff Koons, Jean-Michel Basquiat, Damien Hirst and Richard Prince, almost all the rest are Asian. Other Chinese artists in the top 10 include Wang Guangyi and Yan Pei-Ming. Japan's Takashi Murakami comes in at number eight, while the Indian-born Anish Kapoor, who lives in England, is number 18. It is a seismic shift in an art market dominated by the Western tradition for almost 500 years.

"The total auction revenue generated by 100 Chinese artists in 2003-4 amounted to £860,000," the report says. "The same 100 generated total revenue of £270m over the last 12 months. Of these 100, three are striking for having each generated more than £26m."

Vinci Chang, head of sales at Christie's Asian contemporary department in Hong Kong, said: "These artists grew up in a post-Mao China and have seen a country under decades of turmoil and political and social change. All this has informed their work."

Such is the interest in Chinese art that Charles Saatchi has opened his new gallery in Chelsea with an exhibition of new Chinese talent. Originally, he said, he found Chinese art as very "kitschy" and "derivative". "But there's enough stuff to put on a good show," he said in 2006. "My rule is: if you can put this in the Whitney Biennial and nobody is going to say, 'Oh, that's very good for a Chinese artist,' then that will be fine."

World's 20 top selling artists

1 Jeff Koons, born 1955 in Pennsylvania, incorporates kitsch imagery. Sold £69.4m in the past year.

2 Jean-Michel Basquiat, born 1960 in Brooklyn, New York, was a graffiti artist who died in 1988. Sold £54.3m.

3 Damien Hirst, born 1965 in Bristol, a key member of the Young British Artists. Sold £45.7m.

4 Richard Prince, born 1949 in Panama, is an American painter and photographer. Sold £33m.

5 Zhang Xiaogang, born in 1958 in China's Yunnan province. Sold £32.3m.

6 Zeng Fanzhi, born in 1964 in Wuhan, holds the auction record for a contemporary Asian artist. Sold £27.8m.

7 Yue Minjun, born 1962 in Heilongjiang. Sold £27.8m.

8 Takashi Murakami, born 1962, Tokyo, Japan. Possibly the best known Eastern artist on the list. Sold £15.5m.

9 Wang Guangyi, born 1957, in Heilongjiang. Sold £11.7m

10 Liu Xiaodong, born 1963, Liaoning. Painter and photographer documented the controversial Three Gorges Dam project. Sold £10.5m.

11 Cai Guo-Qiang, born 1957. Performance artist who uses gunpowder to produce 'explosive events'. Sold £10.1m.

12 Yan Pei-Ming, born 1960, Shanghai. Best known for epic portraits of Mao Zedong and Bruce Lee. Sold £9.9m.

13 Chen Yifei, born 1946 in Zhejing. Among the first to break into Western art market. Died in 2005. Sold £9.7m.

14 Fang Lijun, born 1963, Hebei. Painter of the 'cynical realism' school. Sold £9.6m

15 Liu Ye, born 1964, veteran of the post-1989 avant-garde movement. Sold £8.8m.

17 Zhou Chunya, born 1955, Sichuan. Renowned for green portraits. Sold £8.3m.

18 Anish Kapoor, born 1954, in Mumbai, India. Turner Prize-winning sculptor who has lived in England since 1972. Sold £6.7m

19 Peter Doig, born 1959. The Scottish artist's paintings are among Europe's most expensive. Sold £6.7m.

20 Rudolf Stingel, born 1956, in Merano, Italy. Sold £6.5m.

samedi 8 novembre 2008

Bottom falls out of the art market as Manet and Rothko fail to sell

Auctioneers feel the chill as sluggish sales and lower prices signal end of a boom

By Arifa Akbar, Arts Correspondent. Source : The Independt

For so long, the booming art market had appeared impervious to the dipping fortunes of the global economy. But experts now fear the bubble may finally have burst after museum quality paintings by Mark Rothko and Edouard Manet failed to sell at auction. Major sales by Sotheby's and Christie's in New York achieved totals that were millions of dollars below even their lowest estimated prices this week.

On Wednesday night, a post-war and contemporary art sale at Christie's sold half of all the 58 lots at below their expected price, with 30 per cent failing to sell at all. The overall total for the sale was $47m (£38m), well below its estimate of between $100m to $150m.

No43 (Mauve), a painting by Rothko, whose work has set and broken auction records in recent years, failed to sell for between $20m and $30, while multimillion-dollar paintings by Manet did not attract any buyers.

The auction house was last night waiting to see if results of its Impressionist and Modern Art sales would come close to the $240m to $340m estimated total. Marc Porter, Christie's president, reportedly blamed the "difficult economic climate" for the poor results.

A spokesman offered some reassurance, saying: "People are more considered about what they are going to bid for. There is a difference to the art market but at the same time, considering the scale of what's been happening in the financial sector, we are still seeing significant amounts of money changing hands and plenty of liquidity and committed bidding."

Some in the industry suggested the disappointing sales signalled a downturn in the market after a decade of rising prices, and others questioned how much it might plunge.

A Sotheby's sale on Monday night failed to reach its low estimate of $339m, securing only $223m, with a total of 25 works out of 70 remaining unsold including paintings by Monet, Matisse and Cezanne.

A Sotheby's statement said the result was not unexpected in the light of the receding economy but that people were still buying. "This was the first true test of our market in this new environment, and what we saw is that the market is clearly alive," it said. "[The] sale was assembled over the summer and by the time the catalogue came out we were living in a completely different world."

The auction house said bidding among American buyers had remained strong. Three works had bucked the depressing trend, selling for more than $30m, each establishing a record for the artist at auction: Kazimir Malevich's Suprematist Composition sold for $60m, the highest for a Russian work of art at auction, Edvard Munch's Vampire achieved $38m and the Edgar Degas Danseuse Au Repos sold for $37m, also a record for any work on paper ever sold at auction.

The Art Newspaper reported that auction houses were reducing guarantees and lowering reserve prices in the aftermath of weak sales in London and Hong Kong last month. The Wall Street analyst, George Sutton, has predicted entry into "what could be a challenging year for the auction market".

Ian Peck, the chief executive of the art finance firm, Art Capital Group, said the auction results at Sotheby's had been a wake-up call to the art world which "firmly demonstrated that the concept of a recession in the art market is not abstract but real. Prices in all categories – the trophies, the great, and the merely good – were less contested, if at all, and end prices were likely reduced by 20 to 40 per cent".

But Charles Dupplin, from Hiscox art insurers, said it was important to assess the market's financial health after the week-long auctions in New York as well as the Art Basel Miami Beach art fair in December, a major commercial event in the art industry's calender. "It's clearly very tempting to leap to an instant conclusion and there clearly has been a shift in appetite in the market but whether this is realised in prices coming down or not is the real question," he said.

Art and recession: A brief history

The fortunes of the art market tend, as one might expect, to follow those of the economy. After the heady days of the 1980s, the price of art plunged in the early Nineties. However, it was a very different market from today, with collectors from America, Europe and Japan buying largely with borrowed money. When the Japanese economy faltered, so did the art market. It remained in the doldrums for much of the Nineties, after which it began slowly to rise. A tiny dip in 2000 was followed by a further rise, with some parts of the market, such as contemporary and Russian art, growing quicker than others.

Buyers in the Eighties and Nineties formed a narrow collecting pool. Today, there is a much more global group due to modern communication and online bidding. The growth of economies in India and China might soften any impending crash.

mercredi 5 novembre 2008

United colours for Bihar

Source : Times of India

MUMBAI: The victims of the flood in Bihar in August have found good Samaritans in 31 artists from across the country. From Atul and Anju Dodiya and

Jitish Kallat to T V Santhosh and Mithu Sen, artists have donated one work each to an auction organised by Saffron Art, artist couple Subodh Gupta and Bharti Kher, Delhi gallery Nature Morte and the Trident in Gurgaon. Hundred per cent of the proceeds will go to NGOs that work with victims of the flood, said Saffron Art owner Dinesh Vazirani. The works will be auctioned on November 11 and 12 and those interested can visit www.saffronart.com.

The event has been put together in a lightning 20 days. Kher said that she and Gupta urgently called their friends as the condition of the flood victims is quite grim and getting worse. Stories about the global economic meltdown have eclipsed press coverage of flood relief, Vazirani pointed out. Now they have absolutely nothing, said Kher. Its the right time to do an auction. Riyas Komu, one of the contributors, added that Kher and Gupta are doing a worthy thing and that its high time the government tackles natural calamities better. It was an anticipated flood and there had been several warnings.

The even is especially significant for Gupta as he is a native of Bihar. Initially Gupta and Kher had the mad idea that they would go to Bihar themselves to see how they could help. Gupta joked that if he had carried out his plan, he wouldnt have been able to work for at least a year. Two NGOs Goonj and Samajik Shaikshanik Vikas Kendrawill disburse the funds generated by the auction. Vazirani said that a conservative estimate of the target he thinks the auction will achieve is Rs three crore. The upper estimate, he added, is Rs four crore.

The works on display are quite stunning. Bose Krishnamachari, for instance, has served up a psychadelic piece of art titled Stretched Bodies. Delhi-based duo Thukral and Tagra have offered Somnium Genero, a triptych that involves pop art colours, old-fashioned frames and a toaster. In Bharti Khers work, This Way and Never Another Way, tributaries of red, blue, black and white bindis form what looks like a mighty river. The artists have really given great works, Vazirani said. And theyre well-priced. Are the organisers worried that collectors might shy away from spending on art at a time when the global economy is in a deep trough? Gupta explains that he doesnt expect buyers to be chary as theyre not donating money. Even though theyre spending considerable amounts, theyre getting something highly valuable in return, he said. The artists, on the other hand, have donated their paintings without asking for a penny. This is a coming together of artists from India, said Vaziranis wife Minal. Theres a sense of a community. Were able to contribute to the survival of people.