Sat May 24, 2008 By James Pomfret

HONG KONG (Reuters) - A work by Chinese artist Zeng Fanzhi sold for $9.5 million on Saturday, a new auction record for an Asian contemporary artwork, at auctioneer Christie's first evening sale of such art in Hong Kong.

Other records also fell as the auction brought a dash of black-tie glamour to the former British colony's art market, considered the world's third most important auction hub after New York and London.

Affluent Asian collectors were served champagne and canapes before bidding in a packed auction hall. The results suggested the Chinese art market remains resilient despite financial market jitters.

"There is a worldwide enthusiasm," said Jonathan Stone, Christie's International Business Director for Asian Art.

"If you look at the list of buyers in the top ten there were Asian private buyers, European private buyers, there was a very international flavor to the sale," he told Reuters.

The highlight of the evening was Zeng Fanzhi's large-scale 2-by-3.6 meter work entitled "Mask Series 1996 No. 6", which sold for almost triple its pre-sale estimate.

Several telephone bidders helped push the price to HK$75.37 million including the buyer's premium, making it the most expensive Asian contemporary artwork sold at auction, Christie's said.

Zeng's diptych of eight masked youths with red scarves linking arms, hints at Mao Zedong's "Little Red Guards" who wreaked havoc across China during its tumultuous Cultural Revolution.

The work, not previously offered at auction, is considered a highlight of Zeng's "Mask" series of ambiguous Chinese figures contending with life under communist rule.

The previous record for an Asian contemporary artwork was for a set of 14 "gunpowder" drawings by Chinese artist Cai Guoqiang which sold for HK$74.25 million last November.

Other notable results included Chinese contemporary artist Yue Minjun's "Gweong-Gweong", sold for HK$54.1 million ($6.85 million), a new auction record for the artist.

Zeng and Yue are among a group of red-hot Chinese contemporary artists, also including Cai Guoqiang and Zhang Xiaogang, whose works have sold for $6 million or more. A remarkable surge in demand for Chinese art in recent years has been spurred partly by newly affluent Chinese collectors.

Auction records also fell for individual artists from across Asia, including Indonesia, South Korea and India. New Delhi-based Subodh Gupta was the sole non-Chinese artist to break into the top ten Asian contemporary works sold, with his "Saat Samundar Paar (10)" (Across the Seven Seas) fetching $1.2 million.

dimanche 25 mai 2008

Asian art records tumble at Christie's HK auction

samedi 24 mai 2008

A market for the 'Bombay Boys'

By Afsun Qureshi Published: May 24 2008. Source Financial Times

It may not be news for those already entrenched in Indian art, but in terms of the emerging art markets the Indians are definitely coming. "In the past few years, we have seen an art market buoyed by the new wealth and income of Indians based in India, and also by non-resident Indians (NRIs)," says Farah Rahim Ismail, director of Aicon, London's premier gallery of Indian art on Heddon Street (the former space of the Gagosian gallery).

"They are simply taking a new interest not only in the modern masters, but in contemporary art. What they are doing, then, is buying back into their heritage. We have seen increased activity in the past five to eight years, and much of it was through a rush in online buying from sites such as saffronart.com and artsindia.com."

The group of "modern masters" to which Ismail refers consists of veteran artists, either recently deceased or in their senior years. They were members of the Progressive Artists' Group, founded by Francis Newton Souza in 1947 - artists who lived through colonial rule, were active in Gandhi's "Quit India" freedom movement, and were deeply affected by Partition.

For the greater part of their careers, these artists had only modest success, but gradually they have become icons in their homeland. Among them are Souza, Maqbool Fida Husain, Ram Kumar, Syed Haider Raza, Akbar Padamsee and Tyeb Mehta. A somewhat younger grouping of artists in their mid-60s are also pivotal in the Indian contemporary art scene and include Laxma Goud, Anjolie Ela Menon and Nalini Malani.

It was in 2003, when Mehta's room-size triptych "Celebration" sold for more than $300,000 at Christies in New York, that many observers claimed that the turning point for Indian art had arrived. For the buyer it was a very sound investment; in 2005, Mehta's "Mahisasura" went for $1.58m at Christie's in New York.

Buyers of contemporary Indian art are not just newly flush Indians; European and North Americans are also looking on south Asian talent with fresh eyes. "There is a lot of interest from non-Indian buyers who were collecting Chinese art but have been priced out of that market because of the soaring costs," explains Ismail.

Prajit K. Dutta, a partner of Aicon Gallery and founder of artsindia.com, says: "The Indian art market turns over roughly $300m of sales internationally, and much of it can be accounted for by the wealth of the Indian diaspora." He adds: "When you think that the Indian economy is growing at eight per cent a year it means there is a lot of spare capacity to buy. There is no doubt that potential buyers are in place.

"There is also a new consciousness of collecting among Indians. They are not just collecting art but also books, jewellery and so forth."

But are these savvy collectors buying up Indian art for the love of art, or for the investment value? Both, it seems. "If a buyer is spending about $5,000, then it is such a negligible part of a disposable income that it is really because they just like the piece," says Dutta. "Once you get to the $100,000 mark, you have to be concerned about investment value. I always advise potential buyers that they have to like the art first, but, at that price range, you can't ignore the economic reality of it being an investment."

Sant Chatwal, a Manhattan-based NRI, hotel tycoon and modern-day Indian Medici in the making, also buys for love and money. "I think the interest in contemporary Indian art has been fuelled by the high prices fetched by Indian artists at international auction houses. Today there is a frenzy to collect works in anticipation of rising prices. Art collectors are becoming investors to generate returns on their own art investment. " Chatwal is particularly interested in the work of Ganesh Pyne, Jogen Choudhury, Arpita Singh, Anjolie Ela Menon and Bikash Bhattacharya, as well as upcoming artists Chintan Upadhyay and Pushpamala.

There is no doubt that works by artists such as MF Husain are already highly sought after by collectors and, according to Ismail, prices for his best pieces have gone up in price by over 400 per cent (prices for some have reached the $1m mark). This puts him and his contemporaries out of reach for the vast majority of buyers. But there is a group of well-known contemporary artists that is still relatively affordable, and another group still who are on the rise.

The former, known as the "Bombay Boys", is a preternaturally hip group of thirty to forty-somethings, most of whom trained at the Sir JJ School of Art in Mumbai. They are India's answer to the "YBAs" and are receiving recognition far quicker than the masters before them. Like their predecessors, they are influenced by violence and poverty, but are also interested in modern issues: technology, terrorism and the environment. Marquee namesinclude Subodh Gupta, GR Iranna, Riyas Komu, TV Santhosh, Atul Dodiya and Baiju Parthan.

For keen collectors on a budget, there is another grouping of artists who are beginning to cut a swath through not just Mumbai and Delhi, but also through Manhattan and Palo Alto. Young, cheeky and brash, they include Akhilesh, Adip Dutta, Yogesh Rawal, Rathin Kanji, Debanjan Ray, S. Harsha Vardhana, Indrapramit Roy and Smriti Dixit. Their work with linear and modular shapes, audio visual installations and recycled junk is piquing the interest of collectors worldwide.

For Ismail, the changes in the Indian art market and economy can only be good: "The country has such a strong history in mysticism and belief, fantasy and story-telling, and that is being represented in its arts every day. It is a hugely exciting time for Indian art."

vendredi 23 mai 2008

Economy paints a bleak picture for art market

ArtTactic study finds a significant decline in market sentiment, but experts say prices will still continue to rise by Tara Kilachand. Source : Livemint.com The Wall Street Journal

Mumbai: The air of vulnerability that has increasingly become associated with the India story over the past six months has had an impact on the Indian art market as well, with a report released Thursday by a London-based art market research and analysis firm showing a significant decline in sentiment in the market. However, experts downplay the effect this will have on prices over the next few months.

ArtTactic study finds a significant decline in market sentiment, but experts say prices will still continue to riseArtTactic’s latest survey of the Indian art market shows a 13 percentage point dip in its Indian Art Market Confidence Index, a measure based on the responses of 80 experts to questions on the current and future prospects of the economy and the primary and secondary markets for art. While there has been a 17 percentage point increase in the confidence index for modern art and a six percentage point increase in the confidence index for contemporary art, these ga-ins have been offset by a 54 pe-rcentage point fall in the confidence index on the economy.

The sample of 80 respondents includes a mix of collectors, gallery owners, auction houses, dealers and advisers. It includes no artists.

“The difference here is that people are feeling less positive about the prospect of the economy,” said Anders Petterson, managing director of ArtTactic. “This is partly because of the global picture and what impact it might have in India, as well as internal factors like inflation, high oil prices, and other uncertainties.”

Experts believe that the increase in the index for modern and contemporary art indicates that prices in both categories will continue to rise.

“Like anything, the economy is an external factor that one needs to take into account, but that doesn’t mean that people are feeling negatively or they will act differently,” Petterson said. This is particularly relevant in the modern art sector, which rebounded after a gloomy prognosis late last year.

(ART OF INVESTING) Recent record-breaking results for masters such as Ram Kumar, F.N. Souza and M.F. Husain, whose Battle of Ganga and Jamuna: Mahabharata 12 set a personal best at $1.6 million (Rs6.9 crore) at Christie’s March auction, have helped spur buyer confidence after two years of price corrections.

“There might be a slowdown in external factors, but Indians still have the money to buy,” said Ganieve Grewal, Christie’s representative in India, who was in Hong Kong just ahead of Saturday’s Asian contemporary sale which will include 30 works by artists such as Subodh Gupta, Atul Dodiya and Jitish Kallat.

According to Petterson, runaway prices at recent auctions have led to an increase in perceived risk levels, up 8 percentage points from last year. “The potential risk is that prices run ahead of their actual artistic foundation or merit. This could be potentially damaging if the prices move too quickly and then people start asking questions if it is justified.”

In the past year, works by Subodh Gupta and Atul Dodiya have crossed the $500,000 mark, with T.V. Santhosh’s works seeing a particularly staggering rise, from $15,000 to $280,000 . Some dismiss this as the vagaries of a bullish auction market that arguably has little effect on the primary market (composed of galleries and other exhibition spaces where an art work is first put up for sale). “His own prices in the primary market are the same as they were one year back,” said Arun Vadehra, of Vadehra Art Gallery in Delhi.

“What did happen and what is happening today is that people are ready to pay top dollar for very good work,” added Grewal. “When you see really good work it achieves good prices. If the works are average, people are mature enough to be able to distinguish between a good work and an average work.”

The ArtTactic India survey is carried out every six months and was first carried out in May 2007.

mardi 13 mai 2008

L'art indien, nouveau filon

par Isabelle Faure. Source Le Figaro 13/05/2008

Battle of Ganga and Jamuna, de l'artiste indien Maqbool Fida Husain, a atteint en mars dernier la somme de 1,6 million de dollars. (Photo AFP)

La toile d'un artiste indien a atteint 1.6 million de dollars. Les fonds spécialisés se multiplient.

C'est dans l'un des entrepôts reconvertis du quartier des tisserands que Dinesh et Minal Vazirani ont ouvert leur galerie. Une grande salle haute de plafond où défilent les tableaux des jeunes artistes indiens. De confortables canapés invitent à consulter catalogues et livres d'art en sirorant un thé chaud.

Une oasis de paix au milieu des avenues surchargées de la capitale financière. Mais les soirs d'inauguration, une foule huppée se bouscule pour admirer ce que le couple vendra bientôt aux enchères. Peu de gens misaient sur leur succès quand, en 2000, ces deux passionnés d'art ont lancé Saffronart, le premier site Internet de vente aux enchères d'art contemporain indien. Le marché représentait alors 3 millions de dollars par an. Les collectionneurs étaient issus des vieilles familles aristocratiques ou des dynasties industrielles du pays.

Dinesh et Minal ont fait un autre pari : toucher les riches indiens de l'étranger, férus d'Internet. Après des débuts difficiles et à la surprise générale, l'affaire a décollé. « Quand nous avons commencé, il était impossible de trouver deux prix équivalents dans deux galeries différentes pour le même artiste. Nous avons cherché la transparence et l'accessibilité, et Internet était un parfait instrument pour ça, explique Mina. Nous avons pu offrir des prix centralisés, ce qui a donné confiance aux investisseurs. Nous sommes une référence sur le marché maintenant », ajoute-t-elle non sans fierté. Aujourd'hui, le modèle économique de ces diplômés Harvard pour lui, Insead pour elle fait partie des études de cas du programme MBA de Harvard, et le couple s'apprête à ouvrir un bureau à Londres. Leur clientèle s'est étoffée. L'économie indienne bondit au rythme de 9 % l'an, la hausse des salaires et le boom de la Bourse de Bombay ont enfanté de jeunes et riches collectionneurs locaux.

Taux de rendement de 55%

À côté des « classiques », comme Sayed Haider Raza, Tyeb Mehta ou Maqbool Fida Husain, de jeunes artistes comme Atul Dodiya, Subodh Gupta ou Surendran Nair s'arrachent comme des petits pains. Un succès auquel les grandes maisons de ventes aux enchères, Christie's et Sotheby's, ne sont pas étrangères. La première organise des ventes dédiées à l'art indien aux quatre coins du monde. Sa rivale a institué deux ventes annuelles d'art contemporain indien à Londres. D'où l'intérêt croissant des collectionneurs étrangers et des fonds d'investissements.

Après Yatra, lancé en 2005 par Edelweiss Capital et la galerie Sakshi de Bombay, Neville Tuli, le collectionneur et touche-à-tout de l'art indien, a lancé son propre fonds en 2006. Dès la première année, il a affiché un taux de retour sur investissement de 27 %.

Selon le quotidien «Economic Times», le taux de rendement actuariel de l'investissement dans l'art est d'environ 55 %, contre 23 % à la Bourse de Bombay, et un peu plus de 10 % pour l'or. Les fonds spécialisés se multiplient. Aux côtés de Crayon Capital, Kotak Indian Art Fund, ou encore l'anglais The Fine Art Fund, une demi-douzaine d'autres fonds est attendue dans les mois qui viennent. Effet de mode ? Les prix restent encore modestes comparés aux artistes chinois. Le record 1,6 million de dollar a été atteint en mars dernier par l'artiste Maqbool Fida Husain, comparé à 9,5 millions pour l'artiste chinois Cai Guo-Qiang. Mais l'expert Neville Tuli assure que « le marché chinois est beaucoup plus spéculatif » et que « le nombre de collectionneurs authentiques, capables de monter des collections conséquentes et d'ouvrir des musées, sera plus important en Inde à long terme ».

L'art moderne et contemporain indien est à l'honneur chez Christie's à Londres. Une vente de 112 pièces aura lieu le 11 juin pour un montant estimé à 7 millions de dollars. Par ailleurs, 32 pièces de la collection Tinal et Anil Ambani sont exposées pour la première fois au public.

jeudi 8 mai 2008

N S Harsha wins 3rd Artes Mundi Prize

Source : Artes Mundi Prize  The prestigious 40,000 GBP Artes Mundi Prize has been awarded to Indian artist N S Harsha. At an award ceremony on 24 April 2008 at National Museum Cardiff, Jack Persekian, Chairman of the Judging Panel, fellow judge Xu Bing and Sir Robert Finch, Chairman of Liberty International and representing St David’s 2, Artes Mundi’s principal sponsor, presented Harsha with the award.

The prestigious 40,000 GBP Artes Mundi Prize has been awarded to Indian artist N S Harsha. At an award ceremony on 24 April 2008 at National Museum Cardiff, Jack Persekian, Chairman of the Judging Panel, fellow judge Xu Bing and Sir Robert Finch, Chairman of Liberty International and representing St David’s 2, Artes Mundi’s principal sponsor, presented Harsha with the award.

N. S. Harsha is a skilled story teller, combining details of everyday life in his native India with world events and images we have seen on the news. He has turned the Indian tradition of miniature painting into a form that enables him to mix the local with the universal. He uses it to draw our attention to the whimsical, the absurd as much as the tragic and to the internationally significant. He could be described as an artist / philosopher and without judgement, enables us to reflect on the world around us.

“The panel of judges acknowledged the work of all the artists and found coming to a decision extremely challenging” said Jack Persekian. “We based our decision on the artists’ work over the last 5-8 years and were particularly interested in work that added to our understanding of humanity and the

human condition.”

In awarding the prize to N S Harsha, the panel were impressed by the scope of his work and its range and variety of approach, from painting and installation to community activities. “Basing his work upon his locality, cultural traditions and the shifting world of today, Harsha engages and connects with an ever broadening public” said Persekian. The panel stressed the strength of the exhibition at National Museum Cardiff and admired the outstanding presentations by each of the shortlisted artists.

The members of the Artes Mundi 3 Prize Jury were Jack Persekian, Director of the Sharjah Biennale; the Chinese artist Xu Bing, winner of the first Artes Mundi Prize in 2004 and now vice president of the Central Academy of Fine Arts, Beijing; Tuula Arkio, freelance curator, writer and former General Director of the National Art Galleries, Helsinki; and David Alston, curator and Arts Director for the Arts Council of Wales.

The nine artists shortlisted for the Artes Mundi 3 Prize were Lida Abdul, Vasco Araújo, Mircea Cantor, Dalziel + Scullion, N.S. Harsha, Abdoulaye Konaté, Susan Norrie and

Rosângela Rennó.

Artes Mundi Wales International Visual Art Prize. Awarded every two years, the 40,000 GBP Artes Mundi Prize is the largest international art prize in the UK and one of the largest art prizes in the world. It recognises outstanding emerging artists from around the world who discuss the human condition. Xu Bing won the first Artes Mundi Prize in 2004 and Eija-Liisa Ahtila was awarded the second Prize in 2006.

Artes Mundi 3 exhibition runs to 8 June 2008 at National Museum Cardiff and features major works by the nine shortlisted artists.

Artes Mundi organises a two year programme of art, education and work in communities which culminates in the Artes Mundi Exhibition and Prize.

mercredi 7 mai 2008

Sotheby's Annual Sale of Indian Art in London Realises GBP 4.2 Million

source : artdaily.org

LONDON.- Sotheby’s sale of Indian Art in London realised £4,289,775, a figure handsomely in excess of pre-sale expectations (estimate was £2.4-3.4 million). The sale, which was extremely well attended both during the pre-sale exhibition and in the saleroom today, saw spirited and competitive bidding throughout. It demonstrated that the international profile of and market for Indian Art continues to surge forward. 67% of the lots in today’s sale sold for prices in excess of their pre-sale high estimate and an impressive 11 new auction records were established for names including Rabindranath Tagore and Jitish Kallat, among others. A new auction record by medium was also set for Subodh Gupta.

Commenting on the success of today’s sale, Zara Porter- Hill, Head of Indian Art at Sotheby’s, London said: “Indian Art continues to prosper – it's a market on the move. We collated a carefully edited sale with superlative examples from across the board and we are thrilled with the response that we’ve witnessed. We saw strong and encouraging prices achieved throughout today’s sale, with both Modern and Contemporary works performing equally well. Bidding came from a very international audience, which included private collectors, institutions and the trade. The auction was a great success and we now look forward to the international Contemporary sale in New York later this month which features a select group of works by Indian Contemporary artists.”

The sale offered some 120 lots of exceptional quality and provenance which traced the course of Indian Art over the last century and encompassed works by key figures of the Modern Indian Art movement, such as Francis Newton Souza and Akbar Padamsee, through to the cutting-edge names of Subodh Gupta, Bharti Kher and Jitish Kallat.

The sale’s top selling lot was Francis Newton Souza’s (1924-2002) The Red Road, which was hotly contested by at least seven bidders before selling to a client on the telephone for £580,500; the painting had a pre-sale estimate of £250,000-350,000. One of the stars of the Modern section of the sale, the canvas was a gift from Souza to his wife Maria in 1962, a period widely acknowledged as the artist’s most successful, and it was later bequeathed by Maria to the present owner. The painting was exhibited at the Hayward Gallery in 1989.

Two works by Akbar Padamsee (b. 1928) were other notable strong performers in the Modern section of the sale. This artist’s Untitled oil depicting a nude sold for £252,500 against an estimate of £150,000-200,000 while his Untitled archetypal landscape, which is the result of a series of experiments juxtaposing colours and exploring textures, fetched £264,500 against its pre-sale estimate of £150,000-250,000.

The conspicuous success and performance of Indian Contemporary artists at auction that has been seen of late progressed even further today and was another extraordinary highlight of the sale; works from this period frequently doubled or trebled their pre-sale expectations. An Untitled canvas by Subodh Gupta (b. 1974) was the top selling work of this group, achieving £264,500 against a pre-sale estimate of £70,000-100,000 and establishing a new auction record for a canvas by the artist. The successful sale of this work, which dates from 2005, comes hot on the heels of the artist’s triumph in Sotheby’s international sales of Contemporary Art in both London and New York earlier this year.

Bharti Kher (b. 1969) is another artist who is at the forefront of the Indian Contemporary art scene and her striking aluminium panel encrusted with bindis entitled Missing made £106,100 against a pre-sale estimate of £30,000-40,000. As the cover lot of the sale catalogue, the work was hotly contested before being acquired by a bidder on the telephone. Like Gupta, Kher takes her inspiration from a wide range of images and artefacts from her daily life and surroundings.

Other strong results in the Contemporary offerings included: TV Santosh’s (b. 1968) oil on canvas A Handful of Ashes, which sold for £102,500 against its pre-sale estimate of £30,000-40,000; a colourful large-scale diptych by Thukral & Tagra (b. 1976 and 1979) entitled Stop Think Go which sold for £102,500, against a pre-sale estimate of £30,000-40,000; and Jitish Kallat’s (b. 1974) work from a series collectively titled Humiliation Tax, which realised £58,100 against the estimate of £25,000-35,000 – an auction record for the artist.

The sale was also spearheaded by a group of 11 exceptionally rare works from the collection of the late William and Mildred Archer, two remarkable scholars who played a fundamental role in bringing Indian Art to the fore. The works presented were a tribute to the couple’s long and happy relationship with the Indian subcontinent.

Estimated to fetch in excess of £80,000, the group quadrupled this by realising a total of 346,425 and the top selling lots were: Rabindranath Tagore’s (1861-1941) Death Scene, which made £144,500 against an estimate of £15,000-20,000 and his Bird, which sold for £70,100; and Jamini Roy’s (1887-1972) Santal Couple which sold for £29,300. Tagore’s Death Scene established a new auction record for the artist.

vendredi 2 mai 2008

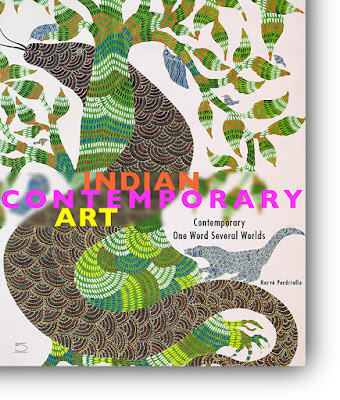

L’art contemporain indien - Un marché explosif

Au milieu des années 90, la forte croissance indienne fait émerger une nouvelle génération de mécènes prêt à investir dans l’art de leurs concitoyens. Aujourd’hui, la demande est mondiale et grandissante, portée par un climat très spéculatif aux possibilités d’allers retour alléchants. Les nouvelles étoiles de l’art indien sont disputées à Hong-Kong et Dubaï, Londres et New-York, New Delhi et Paris.

Dopé par des ventes spécialisées, la progression de l’art contemporain indien est impressionnante : en janvier 2008, le secteur affichait un indice des prix en hausse de 830% sur la décennie !

Source artprice.com Art Market Insight lire la suite