mardi 20 janvier 2009

Picture Imperfect

Source : The Times of India Reputed gallery in New Delhi was forced on Sunday to cancel a show of S H Raza, one of India's best-known painters, after he discovered that the

works attributed to him were fakes. If Satyam dented the image of the Indian IT industry globally, the Raza forgery may have damaged the credibility of the Indian art industry, which has seen a boom in recent times.

Fakes have been reported in the Indian art market before as well. However, the Raza episode is unprecedented for the scale of the forgery. Its perpetrator, who claims to be a nephew of the artist, convinced the gallery that has been in the art trade for years to mount the fakes and dared to have Paris-based Raza at the opening of the exhibition. Clearly, the gallery had not followed basic authentication procedures before organising the show. It has since apologised for the embarrassment caused to the art world but much more needs to be done to rebuild investor confidence in Indian art. The economic meltdown has already slowed down the trade in Indian art and this scam could further dampen the sentiment.

The Raza forgery should serve as a wake-up call for the art industry. Indian art is now estimated to be a Rs 2,000-crore industry and is expected to grow in tandem with the country's economic prowess. With big money chasing art works, fakes are bound to pop up, as has been the case in art markets elsewhere. A slew of measures has been suggested to keep forgeries in check. A national inventory of art works should help to ensure some measure of authentication and keep out fakes. The inventory could be maintained by a body like the Lalit Kala Akademi in collaboration with galleries and artists. Dealers should institute internal audit mechanisms to detect any possible mischief. Authentication and provenance certificates admissible in courts may also help.

Auction houses and galleries must invest in art education so that prospective buyers are not cheated. This would also help to ward off speculators who are keen to fix prices. The Indian art business is young and verifiable information about artists and art works is not always easily available. A well-informed market is necessary if the value of Indian art has to be fully realised. Auction houses, galleries, artists and art lovers should work together to ensure that.

mercredi 14 janvier 2009

Looking back to look ahead

by K S Shekhawat Business Standard

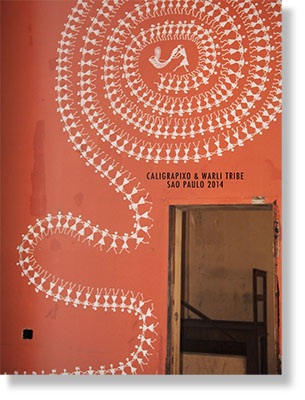

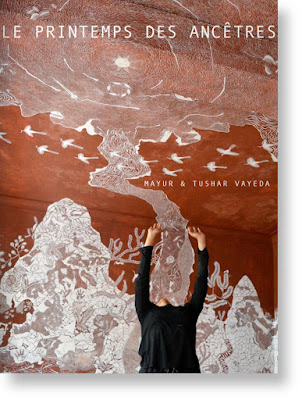

Gallerists say 2009 will mark a transition in the way collectors hedge their choices. The aborted Osian’s auction — it was scheduled to be held at the Taj Mahal Hotel in Mumbai on November 27 — would have been a pointer to a major trend in 2009 : The emergence for collectors of traditional and folk art forms.

> read more

dimanche 11 janvier 2009

Fine Art Fund Group will cash in on falling art prices

By Dominic O’Connell. Source The Sunday Times

ONE of London’s top professional art investors is to set up a special fund to cash in on the bargains thrown up by the credit crunch. Philip Hoffman, chief executive of the Fine Art Fund Group, said he would raise between $50m (£33m) and $100m for an “opportunistic” investment fund.

Hoffman said he expected prices for some art categories – modern and Impressionist works in particular – to fall by as much as 30% this year. “I am now regularly being approached by wealthy individuals or family estates that are looking to sell art without the publicity of going to auction,” he said. “Unfortunately, at the moment their expectations on price are way too high.”

Evidence is mounting that after years of spectacular growth, art prices are falling. The Mei Moses index, which tracks auctions, suggests prices fell by 4.5% last year, after five years of growth averaging 20% a year. Artprice.com, which also tracks auctions, said that the proportion of works worth more than €1m (£882,000) left unsold increased sharply in the second half of last year.

Hoffman said some art owners would have to accept big losses if they needed a fast sale.

There are other indications that the luxury-goods market is flagging in the face of recession.

Business-jet travel in Europe was down around 16% in December compared with the same month last year, according to figures compiled by Eurocontrol, the pan-European air-traffic agency. There were on average 1,540 flights a day in December, 15.9% down. In July there were 2,614 flights a day, although most of the difference is accounted for by seasonality.

Traffic in America is estimated to be down by around 11%, according to a report from analysts at UBS.

Brokers say secondhand aircraft prices have fallen sharply, with a glut of aircraft on the market. The substantial premiums being paid six months ago for the early delivery of new aircraft have also largely disappeared, brokers say.

Investing in art

by Nalini S Malaviya. Source The Economic Times

This year, the stock market has seen major fluctuations and there are still no signs of easing of the economic recession. Investors are facing a dilemma about where to invest. The financial scene appears bleak at the moment, and most predictions point towards a troubled future.

Recent trends in the art market, too, have failed to inspire confidence in investors. Prices of most artists have fallen either substantially or at least marginally. Many senior artists are now opting to have an exhibition of their works without offering any pieces for sale. This appears to be a strategy to try and maintain their market rates, but, how successful it will be, will become clear only over the next few months.

In such turbulent times, investors should be wary of making any fresh investments in art. In case they would like to do so they should consider all aspects related to the art market dynamics - investment timeframe, risk factors and ease of liquidity. You could opt for artists who are considered safe from a financial investment angle, and who have established and proven themselves over the years.

Although, this forms a safe category and involves blue chip artists, the amount of initial capital is fairly high, and that can be deterrent for many investors.

The other option which is appearing attractive is investing in upcoming artists. The major reason why this is catching on in a big way is that prices are low and these make for excellent wall fillers. However, you must be aware that the risk is high with this category. As the capital required is low, many people are open to spending a part of their disposable income on such art. In this case, if you can do a certain amount of research, and back it with technical expertise in order to select quality works, it increases the chances of picking up a winner.

jeudi 1 janvier 2009

The Road Ahead

Source : Express India Vandana Kalra

Despite a looming recession, Indian artists are busy preparing for the several exhibitions slated for 2009

At Christie’s, MF Husain’s diptych Battle of Ganga and Jamuna came under the hammer for over Rs 6 crore in March, and in June the auction house set a record for Indian modern and contemporary art when it sold FN Souza’s Birth for over Rs 10 crore. The year 2008 was filled with success stories for Indian art, until, like everything else, it became victim to the global economic recession. Suddenly auctioneers started finding it difficult to excite bidders. The usually grand art openings became less lavish, with a minimalist menu and a basic catalogue. The timeline for the end of this downslide is hard to predict, but galleries and artists are doing whatever it takes to please connoisseurs for the year ahead.

The Indian art world is most excited about the inauguration of the new wings at the National Gallery of Modern Art. Covering an area of 24,700 sq meters, the new wings will have touch screens to give detailed information regarding programme schedules and will include a larger library, preview theatre, conservation laboratories, a cafeteria and an over 200-seat auditorium. The date for the ribbon-cutting ceremony still remains unannounced, but officials at NGMA have already planned exhibitions for D-day. Select museum collections will be on display, along with Tyeb Mehta’s retrospective and an exhibition of Nandalal Bose’s work that has returned after travelling to San Diego Museum of Art and Philadelphia Museum of Art.

Gallery Espace in New Friends Colony celebrates its 20th anniversary in 2009. “There are two major publications and exhibitions planned in July and December,” says Modi, who has also planned a Mekhala Bahl solo in January and a Nilima Sheikh solo in April at the New Friends Colony Gallery.

Other solo exhibitions in the offing include Amitava Das’s ‘The Body Social’ at Delhi Art Gallery in February and before that Baroda-based Art Home will bring to Delhi, sculptures in steel and wood by Jeram Patel at Triveni Kala Sangam in February. Vadehra Art Gallery will showcase recent work by Anjum Singh and Ram Kumar in January, followed by Rameshwar Broota in February and Anju and Atul Dodiya in April. While Arun Vadehra hopes to accommodate an exhibition of Pakistani women artists that was earlier scheduled for December 2008, Aparajita Jain’s Seven Art Limited will also show works by artists from Pakistan. Titled ‘Breaking News’, this will comprise artwork by Imran Ahmed, Nadia Shaukat and Hamra Abbas. At The Devi Art Foundation, Rashid Rana will curate an exhibition of select artwork from Lekha and Anupam Poddar’s collection to portray contemporary art practice in Pakistan, between August to December.

While one can expect art patrons to hobnob over art by masters like Pablo Picasso and Salvador Dali at Marigold Fine Art’s second exhibition scheduled early next year, in April, French photographer Marc Riboud will display his images at Tasveer. Also in the photo world, Dayanita Singh will showcase coloured photographs for the first time in India at a solo at Nature Morte and Richard Bartholomew’s photographs will be exhibited at Photoink in January.

Those looking for younger talent, meanwhile, can head to Lalit Kala Akademi, where Vadehra will present Shilpa Gupta’s work in March and to Talwar Art Gallery for A Balasubramaniam’s solo in spring.

Will the impressive line-up bring good news for the mart? Vadehra feels that economic graph and art should be viewed independently of each other. “It’s not the first time that there has been a lowdown and the market isn’t that bad. We have had healthy sales in the last few months. One should look forward to good art,” he smiles.